July 4, 2023 — Just trying to keep my head down avoiding "mad men" missiles coming out of nowheres to try and ruin my dreams.

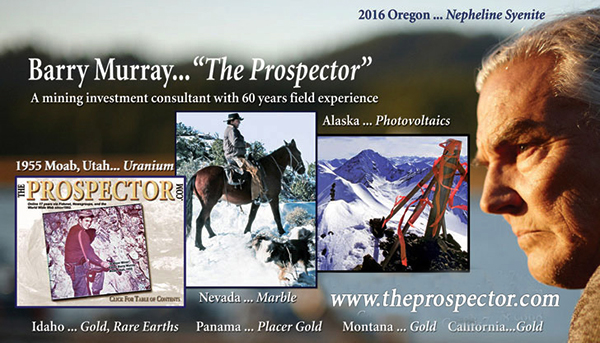

Am I lost on an endless palya? No. After 70-years of prospecting around Wilderness West, I have the skills of navigating without GPS, setting off from and obvious point A, on a dried up lake bed (targets for some of those 'new fangled organic minerals') and with old-fashioned tools, and somehow finding a legal discovery claim post point by latitude/longitude.

That is how the "Old Wild West" was won. Following a Prospector’s Code of telling the truth. As someone following your path may disappear into quicksand without proper warning— if someone from the Wild Wicked East, is not playing fair!

As I recently discovered —thanks to mining my own metrics — my e-mail these past six years may have been censored by hijacking/ blacklisting/ diverted/ quarantined whenever any one of the “web ring” of https://MiningMagazines.com which will be offered for sale or lessee, once I retire. Which leaves involving old-fashioned Wire and Fraud Post Office Inspectors my choice when finalizing legal transactions.

Until then, I need an accredited free speech platform to comment about “unfriendly A.I. falsehoods" that are trying destroy the effectiveness of a “free Internet” that “TheProspector, on FidoNet” has been a contributor to Al Gore's " Information Highway" long before the world-wide-web came along— and stole an election through dark web "misinformation" politics about the Chosen One's "nonsense about Global Warming / Climate change!"? Which really blows public trust away when people look out a window.

Unfortunately, 1930's B-movie rustlers and bankers, using a running iron to alter a BRAND, have lately been using A.I. to claim ownership on stock (livestock, or chattel), which is still traceable back to what "Independent", for not taking SuperPac funding, Independent Senator Bernie Sanders's, calls, "The Wealthy Few".

Lately we all have learned how how "liars, liars" have gained political power through the skilled deceptive use of W.A.I ( Weaponized Artificial Intelligence) by pretending to be on the side of American working family's struggling to survive some great "closer's" flow-through private business plan — "Just do what I do to become a great success. My American patriotic programed voter will follow, somehow still wanting to be in power, will believe"!

.jpg)

Want to argue my points of view?

Call Barry at , 541-961-9209.

A good snapshot of Alleged A.I. Big Business deception by someone in Iceland making a statement about my MiningInvestment.com, by putting up to a search engine choice deflecting to a "LEGIT-MiningInvestment.com? Funny, for as soon as I took a deep look into this A.I. bounce of what was presented to be honest, this remote site disappeared.

The scary part of this alleged B2B cyber warfare is, after years of fighting monopolistic "Russian and Chinese BOTS" is that a healthy FCC and/or the FTC have been "ghosting" my complaints; followed by an FBI examination which could not find any hard proof of deflecting blame for elections gone wrong, is that the "sand-boxed for 20+ years" MininingInvestment.com still remains, while the "LEGIT" version was taken down two days after I laughed about the REDACTED publisher's material.

I understand REDACTED for having a USFS photo Intel security clearance of One-step Above Top Secret (Atomic Codes Level) during the First Cold War. What is curious that recently some US Army general flat out declared on national TV, a 'ghosting' that there never was such a thing. Which I guess is actually protocol today.

Hey, but I want my REDACTED money back for signing a lifetime commitment, which apparently has only empowered high-end legal think-tank attorneys to practice REDACTED-REDACTED law. During my service to America (where our honorable flag had to be destroyed for touching the ground) any political treason would have been taken care of by a Courts-Martial — no matter how high the perps rank — clear up to Commander in Chief with a bone splints cluster on a service ribbon.

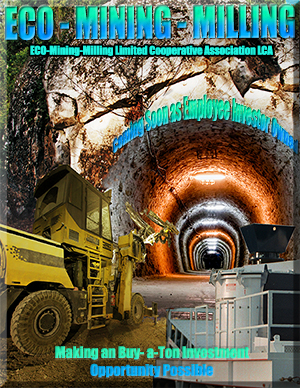

Even scarer to small business operators, as this American independent prospector, with a proven, due diligence documentation ECO-Minerals-Stockpile.net holder that somehow is not certified is trying to compete for an, "In Canadian Interests certification" when searching for an employment opportunity finding an underground Mining Engineer, and crew, to development funding of USA mining geopolymer property competing with a Nepheline Syenite Cartel, with an A.I. generated name listed on a foreign exchanges. Since ECO-Mining-Milling.com is not supposedly in financial competition with the TSX, I guess it is fair to suggest we are looking for underground personnel, qualified by actual experience.

WHY AM I COMPLAINING? Let me ask you: Have you experienced the unexpected when going real mano vs: machine-o when trying to access dishonest information, as to America's interpretation of a French definition of a "Geopolymer" building material contains. I can point out at least two A.I. published papers that what the US Department of Interior, Bureau of Land Management, Bureau of Mines, and US Forest Service consider to be an uncommon use Alumina-Silicate natural Pozzolan "Fly Ash Cement" which does not contain a dangerous manufactured coal ash , scraped from polluting stacks at a diminishing number of electrical generating plants.

And , probably just as everyone without a full-time, expensive, hard to believe sometime, IT Department to combat AI mail selection, where a Microsoft Outlook e-mail address of frontdesk@miningmagazines.com only seems to works for someone I have already contacted with an answer? Which is why someone with a legitimate question may have to go to the end of this one long, single page, no outside advertising website, and graphic to slap old faithful Charlie Horse on the rump to ask your question.

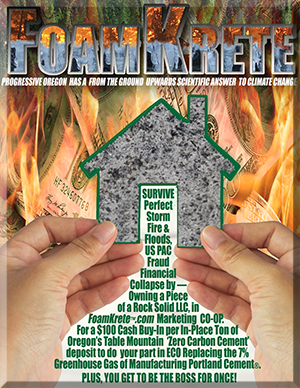

This is a from-the-ground-floor-up get in early opportunity promoted as a 'MiningInvestment'.com pick of https:// ZeroCarbon-Cement.com —only a DBA at the moment— based upon marketing the same chemical formula of SiO2/Al2O3, that also contains two Rare Earths, as the DIY FoamKrete.com from Table Mountain. Oregon, the only other location advantaged US supplier of what 3M depends upon for selling their branded Nepheline 200, which has been listed with an ASTM c-618, and AASHTO m-294, on Ohio ODOT, and CA CALTRANS, to meet standards on Infrastructure Repair contracts.

Go around one sided SEC qualified (millionaires only) investor rules, by simply buying a real piece of rock by the in-place ton, and signing a contract with ECO-Mining-Milling Limited Cooperative Association LCA. Talk to Director Barry Murray how to do this safely, without abuse at 503-753-5868,

Which is why MiningMagazines.com/TheProspector.com/ECO-Mining-Milling.com is offering the undeveloped URL https://ZeroCarbon-Cement.com for outright sale, lease/option, all measured in tonnage from ECO-Minerals-Stockpile, as mined and milled, by ECO-Mining-Milling.com contract where the Limited Cooperative Association LCA (that allows "a patron investment for purchasing ECO modern machinery needed to deliver on an all reasonable costs calculated amortization ROI basis, plus a participation of 10% bonus paid to all members as ready for the wholesale/retail market.

How did a global supply chain for strategic critical minerals happen? Ask Congress how funding of an Oregon U.S. Bureau of Mines Research Facility was a "cost cutting" a budget victory for Wah Chang to walk off with Americas "Rare Earths, which as a keyword phrase more "woke" aware than what "Global Warming, proven Climate Change" disbelievers will admit.

The fun part of stumbling across Nepheline Syenite years before anyone knew what the economics of the "Swiss Army Knife bundle of Strategic Mineral's, including Russian Nepheline Cement, is that when it comes to doing away completely with a green house gas producing (8% of the worlds climate change problem) out of date roasted limestone Portland Cement®, our goal of using Zero-Carbon-Credits by contracting as a "Patron" member of a "preferred provider contractor", ECO-Mining-Milling.com Limited Cooperative Association, selected to ecologically follow through supplying underground mining machinery, and services, as a self contained operator protected jumbo, for loading smaller EV highway legal trucks (equipped with a recharging alternator output when gearing down transporting ore down from 3,000 feet, to a barge loading facility in 17 miles, or a bit further to load on open railroad gondolas — which is cheaper to ship than finished milled material which is in dangered of cementing together when transported in bags or barrels.

Nepheline Syenite was “manufactured” on a convoluted way up from deep mantle magma inside a intrusive pipe to cool into a crystalline sill —just in Creator’s time frame to control Global Warming / Climate Change with amazing answers for us to control:

A) Green house gases released through the manufacturing of Portland Cement®, worldwide causing 7% of the chaos reported by the nightly news showing wild fires, floods, and other 1,000 year events.

B) Control the skyrocketing entry level price to to a hurricane, typhoon, tornado, earthquake resistant, high 'R' value, resistant smart solar rainwater harvesting roof housing — to help control yours or others homeless problems.

C) Furthermore save by DYI basic needs for shelter that is forest fire proof, flood, mold and even bullet proof— more accurately called resistant—which will also help pay a mortgage, and special fire insurance policies for ECO-Housing-America village members.

The US nepheline syenite domestic market market supply is Table Mountain and 2 other 3M quarries, is somehow surviving $600 per processed ton Russian, Canadian, and $400 Per Chinese ton FOB dominance for 3D house printing technology, clear down to built-in bathrooms, marketing a unique Al2O3 SiO2 Rare Earths building material markets. Especially where location, location, is a factor.

Actually a separate contractor —

ECO-Mining-Milling Limited Cooperative Association LCA—as bundling an individual purchase with a required service, as choosing who did the work, would make this a regulated security.

To take individually owned, bought and paid for in-place tons, as FoamKrete™, to avoid "big board" securities problems when advertising a "for sale" wholesale /retail direct FOB product inspired by the very fair and financially successful CO-Plys of the Pacific Northwest, until Clinton's spotted-owl Forestry Act exported the plywood industry to Canada.

One hundred percent working and patron owner (machinery) members vote over wage fairness, and capital costs amortization is designed to do away with destructive and dangerous strikes, or hostile takeovers.

We are searching for a Mining Engineer "Rainmaker" to answer the phone, and more.

As I am neither a qualified tax specialist, or a renown academic Economist —with only "field Experience" of being born in the First 'Great' Depression; surviving food rationing of the Second World; and the third and final FDR's sanctioned Keynesian economics school of thought that broadly states that government intervention is needed to help economies emerge out of recession struggle to deal with debt, when Nixon to us off both the Silver and Gold Standard.

Perhaps they should have used Platinum instead, following the Russians experience of using nepheline syenite for catalytic converters use, was more important in what happened after the Hunt Brothers tried to control a silver which the LME was using to support the historic notion that a Pound was backed by silver, stolen by Rule Britannia legal pirates capturing Spanish trade ships carrying wealth stolen from the Americas.

Which, as I have been crusading that the US Mining Law of 1872 which favors individual American citizens, trying to survive multinational monopolies in control of our natural resources, makes me very concerned about a recent, not very well reported, Supreme Court decision in Glacier Northwest v International Brotherhood of Teamsters, which won a ruling that a company, loosing business due to a strike, could sue said union. Being that I am an chronic unemployed horse packer, you know whose side I am on; even though an Independent in politics, a middle-of-the roader who gets hit by traffic going both ways.

This is why, as editor of a high end gloss print magazine, Economic Currents in the 1990s I featured W. Edwards Demings 14 points of a Total Quality Management System. Something that Japan used to rebuild their automobile industry. For me, with previous experience in running remote mineral exploration camps, by contract for some big industry names, I know everybody looses when their is strife between the haves, and the have no say in the main mission of how to compete product quality.

Those in the building materials business know Glacier Northwest as what had started out as the California Portland Cement Company in 1891, that expanded west of the Mississippi as CalPortland, and then to British Columbia, and Alberta, becoming Glacier Northwest, after settling environmental disputes over in a number of pit quarries. And what really happened over bottom line cost cuttings for profit, was that the outdated practice of delivering a 1900s concrete, in old fashioned rotary trucks, which would set up if caught in traffic, became a "no win" tool

To further protect unsuspecting individual investors from a Tax Accountant/ Members of the Bar, which is also perhaps a 'Union', finding themselves in a new Net Investment Tax or retirement portfolio, it is suggested by those who have also have been made to jump through unfordable loopholes, that a quicker ROI from individual production contracts from market competitors FoamKrete.com, for Do-it-Yourself-ers; ECO-Roman-Cement.com, designed for architects /engineers: and a 'Do-Right' ZEROcarbon-Cement.com which will be giving larger construction materials company's an opportunity to work out Carbon Neutral trades. The goal being to add some new Rare Earths aggregate chemistry in what is not a patented procedure to produce a total ZEROCARBON-Concrete that also will not require steel (pollution by manufacturing) re-bar that rusts, causing catastrophic collapses.

The "Total Quality Movement" active individuals sharing in ECO-Mining-Milling separate contract with a guaranteed CO-OP 10% royalty, for mining and milling services on an "All reasonable Expenses and salerys return" for processing an ECO material, should also consider the possibilities of a much higher ROI by participating in the buy-the-ton to market programs, as described in really ahead of Portland Cement® production tricks trying to reach our ZeroCarbon-Concrete.com standards, based upon "Smarter, Stronger, Better, Cheaper" as supported by TheProspector.com and Barry Murray who is reachable at frontdesk@MiningMagazines.com

I am not a tax professional, but I know through experience that Individuals that file a Schedule C attached to a 1040 is a better way than getting hit with some of the "surprise, you are selected to "rich taxes" showing up in some locales to pay for the cost of homelessness.

To establish a true claim to use a ZeroCarbon-Cement.com as a binder far superior to advertised "Carbon Neutral" —perhaps obtained by Carbon-Credits-Trading or Swaps— requires that a SiO2 / Al2O3 Natural Pozzolan have a matching aggregate to bring the 84.6 % Geopolymer to a 100% GoGreen Aggregative Standard.

What I am hoping to achieve, with other Mensa level Asperger's thinkers (Musk, Jobs, Buffet, Gates, Thunberg, Gore, Ford, Tesla) is to take an ECO-Roman-Cement.com further away from a quicklime base (which requires some heat) to a work with a embedded organic mineral semiconductor function as a "hot wheels strip track" supplying solar generated energy to power an anti-carbon EV engine.

To really compete with 100% percent aggregate Zero Carbon Concrete, and who knows what else with a Swiss Army Knife of mineral uses, I am looking for a $2.5 Million Grubstake (guaranteed by my $100 per ton, plus 2.5% royalty on Table Mountain Mountain ore) for a super geopolymer additional aggregate I know of from early prospecting adventures.

This will be my final Soirée before I saddle up and keep right on heading for the far horizon. That statement might make a bit more sense to "flat landers" if you take a peek at my mountain man https:// bannerbooks.com /bannersearchsamplechapters.pdf. This is a $90 coffee table book which will be gifted as an individually inscribed and signed by the author mail delivery upon a worthwhile tonnage sale.

As I am 84 years —going on 100, as 99.5 just will not do! Retiring from my minerals career which started almost 70 years ago being hired to prospect for Uranium, Rare Earths, and Industrial Minerals, including Photovoltacis associated with silver and gold, will be painful if an unqualified business broker tries once again to leverage a nothing down "expert tire kicking for financial control over a proven, ready to underground mine 250 Million Ton deposit of Nepheline Syenite.

It is one thing to represent independent dealer Zero Carbon Cement distributors networks, as FoamKrete.com, or Sharon Ehlmanns ECO-Roman-Cement.com (818-214-9800) as already listed in small lots on TradeforBarter.com, or our new home building materials /for developeable land exchange — Barter4Trade where I am looking for a retirement horse ranch, and/or a blue water cruising cateraman.

Talk the possibilities with Me: 541-961-9209

My financial expertise curricula vitae can be condensed down to a "Been There, Done That" T-shirt. Which is why I am not selling individual claims covering a full square surface mile. As the proven length x width x depth uniform value geopolymer "natural pozzolan deposit", and hopefully some super-concrete additives, have not really been established, I am offering an early-in discount for risk takers that can move fast enough (perhaps by an option) on bulk sales.

Call Miz Bobby at 503-753-5868 on this. Or, Sharon Ehlmann at 818-214-9800.

Or, slap Charlie Horse on his butt to set him off at a Pony Express gallop.